It was an extreme privilege to land an internship in Cook County Commissioner Bridget Gainer’s office at the start of my career.

The topic was of utmost priority: Cook County was being ravaged by the foreclosure crisis, and we had to learn from our own successes and failures.

I am proud of the work that was produced, and proud to have played a part in its production.

final-report-draft-2-cook-county-foreclosure-study.pdf

Introduction

In the first quarter of 2011 nearly half of all mortgaged homes in Chicago were

In 2010, Cook County began funding the Circuit Court of Cook County Mortgage Foreclosure Mediation Program. Its goal is to “deliver critical services to Cook County homeowners in crisis as early as possible once the foreclosure process begins.”2

The foreclosure situation is continuing to evolve. It is necessary to continually evaluate and discuss the surrounding conditions to offer the best possible remedy.

The purpose of this report is to add statistical and anecdotal data to the conversation assessing the foreclosure crisis and mediation efforts of Cook County, Illinois.

To achieve the stated purpose three surveys were used to gather the necessary data: a survey of community organizations and agencies that work with and counsel those affected by foreclosure, a survey of community members at large regarding their perception of the foreclosure crisis and a survey of homeowners directly affected by foreclosure.

This report concludes that the Cook County Foreclosure Mediation Program is a positive step to assisting those in foreclosure. However, greater funding needs to be dedicated to early outreach and institutional policies need to be streamlined to reflect best practices.

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

1!Zillow.com! 2!http://cookcountyforeclosurehelp.org/!

1

over 10,000 in 2000 to well over 50,000 per year by 2010.

underwater.

The number of foreclosure filings in Cook County has jumped from just

! 2!

PART I: Survey of Foreclosure Counseling Organizations

This report received responses from 27 community organizations and agencies throughout Cook County. The organizations surveyed include HUD-Certified foreclosure mediation agencies, Chicago’s Technical Assistance – Community (TA- COM) counseling agencies, and community organizing coalitions partnering with the aforementioned.

These organizations range in office size and capacity. The majority report having an office smaller than 4 staff members, while a couple report having an office larger than 10 staff members. Combined, they provide services in over a dozen languages, including English, Spanish, Polish, Chinese Mandarin, Russian, and Vietnamese.

11 identified as being directly involved in the Cook County Foreclosure Mediation Program.

These organizations counsel both homeowners in or at risk of foreclosure and renters affected by foreclosure. Greater emphasis is placed on homeowner counseling, as a

How$many$clients$per$quarter?$

200!+!!! 101=200!! 51=100!! 1!=!50!

Renters!

Homeowners!

0! 5! 10!

15! 20! 25!

! 3!

majority of organizations, 14 of the 27, report counseling more than 50 homeowners per quarter. As for renters, a majority of the organizations, 20 of the 27, report counseling 50 or less.

While most organizations report that their clients seek counseling only after they have received a notice from their bank or lending agency, many organizations report their clients seeking counseling during pre-foreclosure phase, when they are behind in payments but have not yet received bank notice. A minority of organizations reprot that their clients seek counseling only after they have received a court ordered foreclosure notice.

When$do$clients$seek$help?$

Judicial! Notice! 22%!

Bank!Notice! 48%!

Pre= foreclosure! 30%!

! 4!

How$many$cases$end$in$foreclsoure?$

51%!or!more! 26%!=!50%! 25%!or!less!

Organizaitons!

0! 2! 4! 6! 8! 10! 12! 14! 16! 18!

The counseling agencies report a high success rate. Out of the 22 agencies that counsel homeowners, 16 report 25% or less of their counseled homeowners end in foreclosure. 6 of these organizations report slightly higher numbers: between 26 – 50% of their counseled homeowners end in foreclosure. No organization reported a number greater than 50%.

The various organizations agree that more needs to be done to address community needs. Specifically, they rate the response of government agencies uniformly low. 86% of the organizations feel that community needs are only “somewhat” or “barely” being addressed. An additional 3% feel that community needs are not being addressed at all.

Rate$the$government’s$response:$

Poor! Needs!Work! Fair! Great!

Organizaitons!

0! 2! 4! 6! 8! 10! 12! 14! 16!

! 5!

Conversely, only 3% of the organizations feel the government response to the foreclosure crisis has been “great.” The plurality, 45% of the organizations, state that the response “needs work,” and 28% rank the response at “poor.”

Suggestions

The organizations also voiced their opinions on how to improve the foreclosure process to benefit those affected. Most organizations discussed the Cook County Foreclosure Mediation Program.

Overall, the agencies are pleased that Cook County has taken the necessary first step to creating a holistic mediation program. However, the program is not with out its areas of needed improvement, which these organizations identify.

The organizations call for greater funding specifically dedicated to outreach at the local level. They also would like to eliminate duplicity and streamline the mediation process. Lastly, they advocate for an effort to rehabilitate foreclosed properties to be placed back on the market as affordable or rental housing.

“Continue the cook county mediation program. There is a need for more funding to be able to maintain non-for-profit organizations staff to help clients on foreclosure intervention counseling.”

-The Latin United Community Housing Association

“We are concerned the Cook County mediation program is less effective than it could be. We would like the program to be modified to allow neighborhood-based HUD agencies like our own to receive funding for counseling provided to owners who are enrolled in mediation, as opposed to requiring duplicate counseling once owners are in mediation.”

-Lakeside Community Development Corporation

! 6!

“Having all judges tell homeowners about the mediation program… Once homeowners are enrolled in the mediation program, it has too many loops for the homeowners to cross. The number of homes saved through the mediation program is very low in comparison to the number of homeowners that have called the mediation program for assistance. “

-Brighton Park Neighborhood Association “

“Marketing funds have to be made available so that borrowers know that the housing counseling agencies are open to assist.”

– Voices of Community Ministerial Association

“The County Mediation Program needs to have some accountability measures for banks, and homeowners, to assure that they both are making good faith efforts to resolve the situation.”

-Interfaith Leadership Project writes,

“The foreclosure mediation program is a good start,” but argues that the process is never made clear to homeowners. “There needs to be a sheet given to homeowners about the steps of the program clearly laid out.”

– Bethel New Life

“Put foreclosed properties back in the community for affordable rental or lease to own.”

– Partners in Community Building Inc

! 7!

PART II: Survey of Community Members of Cook County

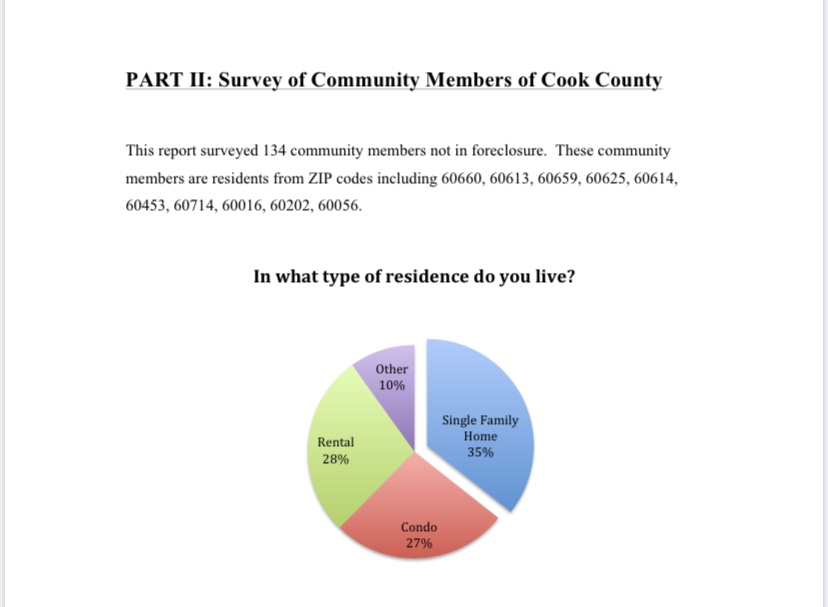

This report surveyed 134 community members not in foreclosure. These community members are residents from ZIP codes including 60660, 60613, 60659, 60625, 60614, 60453, 60714, 60016, 60202, 60056.

Those surveyed live in a diverse range of housing type. 35% of those surveyed, live in a single-family home. Most others either rent their housing unit or own a condo, and a small number report living in another form of housing, such as a co-op.

In$what$type$of$residence$do$you$live?$

Other! 10%!

Rental! 28%!

Condo! 27%!

Single!Family! Home! 35%!

! 8!

How$many$foreclosures$occur$in$your$ neighborhood?$

31%!or!more! 21%!=!30%! 11%!=!20%!

Residents!

10%!or!less!

0%! 5%! 10%! 15%! 20%! 25%! 30%! 35%! 40%! 45%!

This report went on to ask community members to estimate the rate of foreclosure in their neighborhood as a percentage of the local housing stock. Most estimated that the foreclosure rate was at 10% or less. However, nearly 35% of those surveyed did estimate that the foreclosure rate was higher than 21%.

When asked to assess the consequences of the foreclosure crisis, 41% argued that their property taxes have gone up as a direct result of local foreclosures. An even greater number, 88%, stated that the foreclosure crisis had discouraged economic development and growth in their neighborhood.

Cross-referencing data sets reveal that homeowners are more likely than renters to estimate that property taxes have gone up and business development has slowed due to the foreclosure crisis.

! 9!

Who$is$to$blame?$

other! homeowners! government! banks!

0%! 10%!

20%! 30%! 40%! 50%! 60%! 70%!

When asked who is responsible for the large number of foreclosures, the results are one sided. Two-thirds blame the banks and the lending industries. Only 10% feel the government and its agencies are to blame, and even fewer blame homeowners. It is important to note that those who marked “other,” often cited a specific bank institution or bank policy, such as, “robo-signing.”

80% of those surveyed were unaware of the Cook County Mortgage Foreclosure mediation program.

“It would be great to know, or get if one not in place, a toll free number that can deal with all the resources available for taxpayers in foreclosure in or in danger of foreclosure.”

-60402

!

10!

PART III: Survey of Homeowners affected by Foreclosure

This report surveyed 108 homeowners who are going through the foreclosure process. These homeowners in foreclosure are residents from ZIP codes including 60660, 60613, 60659, 60625, 60614, 60453, 60714, 60016, 60202, 60056, 60022, and 60693.

Of those surveyed, 10 were veterans, 9 had a disability, and 41 were single parents. Most self identified as a minority. 15 reported a primary language other than English.

There household size and annual income varied. About 20% of those surveyed lived alone, while 30% lived with one other person. The other 50% of those surveyed were split between being in a household of less than 5 and more than 5 respectively. The majority of those surveyed earn between $20,000 and $49,000.

A cross reference of data sets reveals that single parents had a household income less than the average survey taker.

Hoemowenr’s$Annual$Income$

90k!or!more! 75k!=!89k! 50k!=!74k! 35k=49k! 20k!=!34k! Less!than!20k!

3%! 4%!

8%!

19%!

32%! 25%!

! 11!

45!

What$contributed$to$your$default?$

Homeowners!

16!

Financial! hardship!due!to!hardship!due!to!hardship!due!to!hardship!due!to!predatory!loan!

loss!of! employment! employment! health! practices! employment! hours!cut! wage!cut!

17!

13!

24! 8!

Financial!

Financial!

Financial!

Victim!of!

Other!

When asked to enunciate the cause of the financial hardship that contributed to their mortgage default, the vast majority indicated their employment status. In addition, a dozen listed their health, and others were victims of predatory lending practices.

While a large portion of individuals surveyed said they sought counseling while in the pre-foreclosure stage, half of all surveyed reported that they sought counseling only after

Judicial!Notice! 1%!

Current! 10%!

Bank!Notice! 50%!

When$do$homeowners$seek$help?$

Pre=foreclosure! 39%!

! 12!

receiving an official bank notice. One reported that they had received a court order by the time they sought counseling.

It is important to note that a number of respondents, about 10%, were still current with their payments when they sought counseling, and did so because they expected difficulties in the future.

Individuals reported their mortgages were held from a variety of lenders. The two most popular banks were Bank of America and Chase. PNC, GMAC, and FreddieMac rounded off the top five lenders list respectively.

Other! PNC! Fannie! Harris! GMAC! Freddie! Citi! Chase! B!of!A!

22%!

Banks$and$Lenders$

12%!

1%!

7%!

9%! 8%!

5%!

22%! 22%!

! 13!

Rate$the$lender’s$response$to$your$needs:$

Homeowners!

49%!

14%!

Great!

13%!

Fair!

22%!

Needs!work!

Poor!

Most felt that they did not receive an adequate response from their bank or lender. Nearly half of those surveyed rated the response as “poor.”

Homeowners affected by foreclosure felt a little more served by the governmental services, with most respondents rating the services as “somewhat helpful.” Still, about one-third stated the services were “not at all helpful.”

Rate$the$governents$response$to$your$needs:$

Homeowners! 41%!

9%!

36%!

14%!

Very!helpful!

Somewhat!helpful! Barely!helpful! Not!at!all!helpful!

! 14!

Conclusions

After reviewing the data, This report concludes the following:

1. As reported by both counseling agencies and homeowners, most homeowners who receive counseling seek it after receiving an official bank notice to begin foreclosure proceedings. Counseling agencies report this to be true 48% of the time, while homeowners report this to be true 50% of the time. Some even wait to seek counseling until they receive a judicial notice. Of course, by then it is too late for counseling to be effective. Therefore, this report recommends following the advice of the local outreach agencies and dedicating more funding to outreach-efforts. The earlier the program can reach a homeowner, the more time the counselor will have to provide mediation.

2. Many of the local mediation agencies are more successful in avoiding foreclosure than the Cook County Mediation Program. Sixteen of the surveyed agencies report that less than 25% of their clients end in foreclosure. The Cook County Mediation Program reports that 46% of their clients end in foreclosure. This is a significant difference in success rate. Therefore, this report recommends that further research be conducted to analyze the practices of the local agencies, and restructure the mediation program to follow those best practices.

Foreclosures in Cook County represent an evolving situation. There is a need for ongoing discussion to provide clarity and solutions.

!

! 15!

Introduction

In the first quarter of 2011 nearly half of all mortgaged homes in Chicago were underwater.蜉 The number of foreclosure filings in Cook County has jumped from just over 10,000 in 2000 to well over 50,000 per year by 2010.

In 2010, Cook County began funding the Circuit Court of Cook County Mortgage Foreclosure Mediation Program. Its goal is to “deliver critical services to Cook County homeowners in crisis as early as possible once the foreclosure process begins.” Hi

The foreclosure situation is continuing to evolve. It is necessary to continually evaluate and discuss the surrounding conditions to offer the best possible remedy.

The purpose of this report is to add statistical and anecdotal data to the conversation assessing the foreclosure crisis and mediation efforts of Cook County, Illinois.

To achieve the stated purpose three surveys were used to gather the necessary data: a survey of community organizations and agencies that work with and counsel those affected by foreclosure, a survey of community members at large regarding their perception of the foreclosure crisis and a survey of homeowners directly affected by foreclosure.

This report concludes that the Cook County Foreclosure Mediation Program is a positive step to assisting those in foreclosure. However, greater funding needs to be dedicated to early outreach and institutional policies need to be streamlined to reflect best practices.

PART I: Survey of Foreclosure Counseling Organizations

This report received responses from 27 community organizations and agencies throughout Cook County. The organizations surveyed include HUD-Certified foreclosure mediation agencies, Chicago’s Technical Assistance – Community (TA-COM) counseling agencies, and community organizing coalitions partnering with the aforementioned.

These organizations range in office size and capacity. The majority report having an office smaller than 4 staff members, while a couple report having an office larger than 10 staff members. Combined, they provide services in over a dozen languages, including English, Spanish, Polish, Chinese Mandarin, Russian, and Vietnamese.

11 identified as being directly involved in the Cook County Foreclosure Mediation Program.

These organizations counsel both homeowners in or at risk of foreclosure and renters affected by foreclosure. Greater emphasis is placed on homeowner counseling, as a majority of organizations, 14 of the 27, report counseling more than 50 homeowners per quarter. As for renters, a majority of the organizations, 20 of the 27, report counseling 50 or less.

While most organizations report that their clients seek counseling only after they have received a notice from their bank or lending agency, many organizations report their clients seeking counseling during pre-foreclosure phase, when they are behind in payments but have not yet received bank notice. A minority of organizations reprot that their clients seek counseling only after they have received a court ordered foreclosure notice.

The counseling agencies report a high success rate. Out of the 22 agencies that counsel homeowners, 16 report 25% or less of their counseled homeowners end in foreclosure. 6 of these organizations report slightly higher numbers: between 26 – 50% of their counseled homeowners end in foreclosure. No organization reported a number greater than 50%.

The various organizations agree that more needs to be done to address community needs. Specifically, they rate the response of government agencies uniformly low. 86% of the organizations feel that community needs are only “somewhat” or “barely” being addressed. An additional 3% feel that community needs are not being addressed at all.

Conversely, only 3% of the organizations feel the government response to the foreclosure crisis has been “great.” The plurality, 45% of the organizations, state that the response “needs work,” and 28% rank the response at “poor.”

Suggestions

The organizations also voiced their opinions on how to improve the foreclosure process to benefit those affected. Most organizations discussed the Cook County Foreclosure Mediation Program.

Overall, the agencies are pleased that Cook County has taken the necessary first step to creating a holistic mediation program. However, the program is not with out its areas of needed improvement, which these organizations identify.

The organizations call for greater funding specifically dedicated to outreach at the local level. They also would like to eliminate duplicity and streamline the mediation process. Lastly, they advocate for an effort to rehabilitate foreclosed properties to be placed back on the market as affordable or rental housing.

“Continue the cook county mediation program. There is a need for more funding to be able to maintain non-for-profit organizations staff to help clients on foreclosure intervention counseling.”

-The Latin United Community Housing Association

“We are concerned the Cook County mediation program is less effective than it could be. We would like the program to be modified to allow neighborhood-based HUD agencies like our own to receive funding for counseling provided to owners who are enrolled in mediation, as opposed to requiring duplicate counseling once owners are in mediation.”

-Lakeside Community Development Corporation

“Having all judges tell homeowners about the mediation program… Once homeowners are enrolled in the mediation program, it has too many loops for the homeowners to cross. The number of homes saved through the mediation program is very low in comparison to the number of homeowners that have called the mediation program for assistance. “

-Brighton Park Neighborhood Association “

“Marketing funds have to be made available so that borrowers know that the housing counseling agencies are open to assist.”

– Voices of Community Ministerial Association

“The County Mediation Program needs to have some accountability measures for banks, and homeowners, to assure that they both are making good faith efforts to resolve the situation.”

-Interfaith Leadership Project writes,

“The foreclosure mediation program is a good start,” but argues that the process is never made clear to homeowners. “There needs to be a sheet given to homeowners about the steps of the program clearly laid out.”

– Bethel New Life

“Put foreclosed properties back in the community for affordable rental or lease to own.”

- Partners in Community Building Inc

PART II: Survey of Community Members of Cook County

This report surveyed 134 community members not in foreclosure. These community members are residents from ZIP codes including 60660, 60613, 60659, 60625, 60614, 60453, 60714, 60016, 60202, 60056.

Those surveyed live in a diverse range of housing type. 35% of those surveyed, live in a single-family home. Most others either rent their housing unit or own a condo, and a small number report living in another form of housing, such as a co-op.

This report went on to ask community members to estimate the rate of foreclosure in their neighborhood as a percentage of the local housing stock. Most estimated that the foreclosure rate was at 10% or less. However, nearly 35% of those surveyed did estimate that the foreclosure rate was higher than 21%.

When asked to assess the consequences of the foreclosure crisis, 41% argued that their property taxes have gone up as a direct result of local foreclosures. An even greater number, 88%, stated that the foreclosure crisis had discouraged economic development and growth in their neighborhood.

Cross-referencing data sets reveal that homeowners are more likely than renters to estimate that property taxes have gone up and business development has slowed due to the foreclosure crisis.

When asked who is responsible for the large number of foreclosures, the results are one sided. Two-thirds blame the banks and the lending industries. Only 10% feel the government and its agencies are to blame, and even fewer blame homeowners. It is important to note that those who marked “other,” often cited a specific bank institution or bank policy, such as, “robo-signing.”

80% of those surveyed were unaware of the Cook County Mortgage Foreclosure mediation program.

“It would be great to know, or get if one not in place, a toll free number that can deal with all the resources available for taxpayers in foreclosure in or in danger of foreclosure.”

-60402

PART III: Survey of Homeowners affected by Foreclosure

This report surveyed 108 homeowners who are going through the foreclosure process. These homeowners in foreclosure are residents from ZIP codes including 60660, 60613, 60659, 60625, 60614, 60453, 60714, 60016, 60202, 60056, 60022, and 60693.

Of those surveyed, 10 were veterans, 9 had a disability, and 41 were single parents. Most self identified as a minority. 15 reported a primary language other than English.

There household size and annual income varied. About 20% of those surveyed lived alone, while 30% lived with one other person. The other 50% of those surveyed were split between being in a household of less than 5 and more than 5 respectively. The majority of those surveyed earn between $20,000 and $49,000.

A cross reference of data sets reveals that single parents had a household income less than the average survey taker.

When asked to enunciate the cause of the financial hardship that contributed to their mortgage default, the vast majority indicated their employment status. In addition, a dozen listed their health, and others were victims of predatory lending practices.

While a large portion of individuals surveyed said they sought counseling while in the pre-foreclosure stage, half of all surveyed reported that they sought counseling only after receiving an official bank notice. One reported that they had received a court order by the time they sought counseling.

It is important to note that a number of respondents, about 10%, were still current with their payments when they sought counseling, and did so because they expected difficulties in the future.

Individuals reported their mortgages were held from a variety of lenders. The two most popular banks were Bank of America and Chase. PNC, GMAC, and FreddieMac rounded off the top five lenders list respectively.

Most felt that they did not receive an adequate response from their bank or lender. Nearly half of those surveyed rated the response as “poor.”

Homeowners affected by foreclosure felt a little more served by the governmental services, with most respondents rating the services as “somewhat helpful.” Still, about one-third stated the services were “not at all helpful.”

Conclusions

After reviewing the data, This report concludes the following:

As reported by both counseling agencies and homeowners, most homeowners who receive counseling seek it after receiving an official bank notice to begin foreclosure proceedings. Counseling agencies report this to be true 48% of the time, while homeowners report this to be true 50% of the time. Some even wait to seek counseling until they receive a judicial notice. Of course, by then it is too late for counseling to be effective. Therefore, this report recommends following the advice of the local outreach agencies and dedicating more funding to outreach-efforts. The earlier the program can reach a homeowner, the more time the counselor will have to provide mediation.

Many of the local mediation agencies are more successful in avoiding foreclosure than the Cook County Mediation Program. Sixteen of the surveyed agencies report that less than 25% of their clients end in foreclosure. The Cook County Mediation Program reports that 46% of their clients end in foreclosure. This is a significant difference in success rate. Therefore, this report recommends that further research be conducted to analyze the practices of the local agencies, and restructure the mediation program to follow those best practices.

Foreclosures in Cook County represent an evolving situation. There is a need for ongoing discussion to provide clarity and solutions.